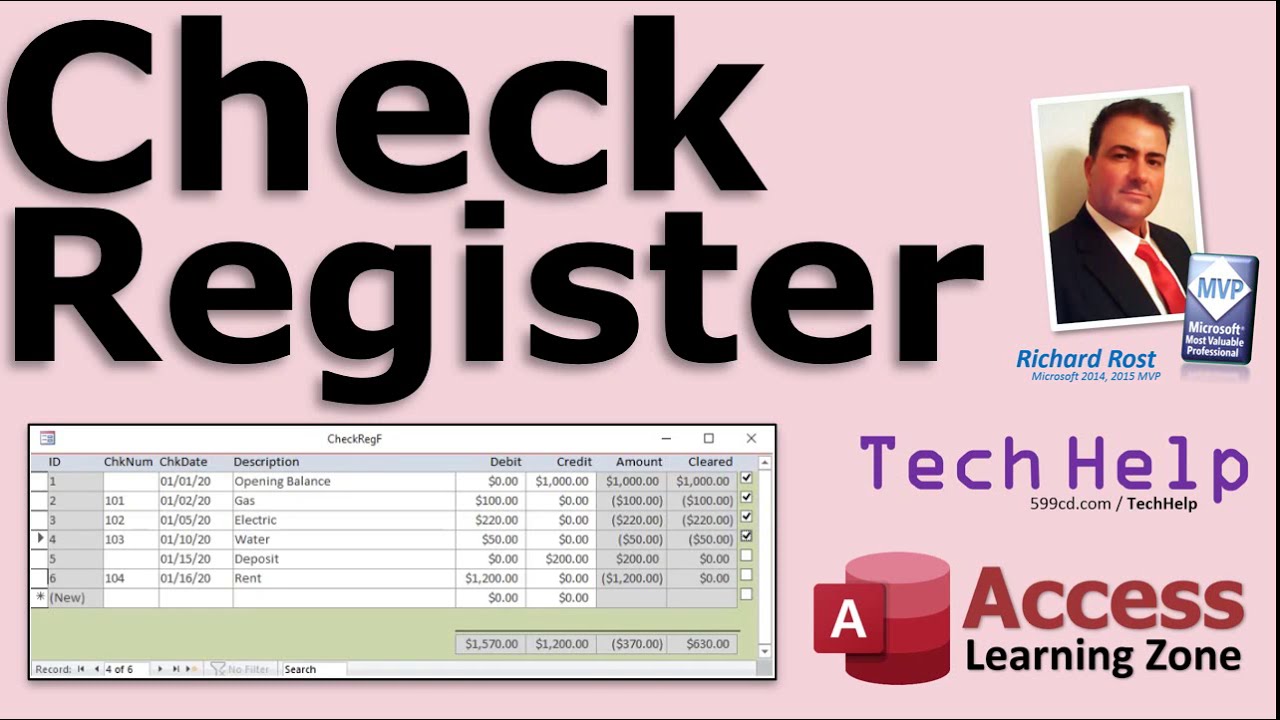

Additional account groups can be added and inserted in the appropriate location on the income statement, cash flow statement and balance sheet. You can customize the descriptions of the account groups but we do not recommend changing the account group keys. Groups - this sheet contains the default list of account groups that are used in this template. The first financial year, reporting year and year-end input cells determine the monthly periods that are included on the trial balance, income statement, cash flow statement and balance sheet. The sales tax codes & percentages are used to calculate sales tax on all income & expense transactions and bank codes can be used to allocate transactions to multiple bank accounts. Setup - enter your business name to change the headings on all the sheets and customize the sales tax codes and bank codes. The template includes the following sheets: If you do not need to produce invoices for customers, the Basic Accounting template should be used.

Note: The main difference between our Basic Accounting and Service Based Accounting templates is that the Service Based Accounting template also includes customer details and invoicing. After completing the initial template setup, the template can be rolled forward or back by simply changing the reporting year in a single input cell. It also accommodates sales tax calculations and multiple bank accounts. The template is easy to use and can be customized by editing the default accounts and adding an unlimited number of additional accounts.

This innovative accounting template enables users to record income & expenses and automatically produces a trial balance, income statement, cash flow statement and balance sheet.

0 kommentar(er)

0 kommentar(er)